User Guide - Ascendo Money - Personal Finance Manager for BlackBerry - Version 3

Chapter 3 - Using Ascendo Money for BlackBerry

When you install software on a BlackBerry, an application icon is placed on

the home screen. On some devices, the application icon is placed in the

Applications Folder or Download Folder. To start Ascendo Money,

use the track ball or track wheel to move to the appropriate folder, highlight

the Ascendo Money icon pictured in Figure 2, then click on the icon to start Money.

Figure 2

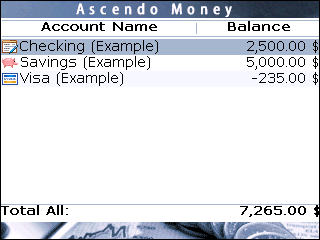

Section 3.1 - Managing Accounts

The first screen

displayed when you start Ascendo Money is the Accounts screen, see Figure 3. A

few sample accounts are created when you install Money but you can delete or

modify them at any time.

Figure 3

Ascendo

Money will display the total of the default currency in the lower left of

the screen. If you have accounts with multiple currencies, you can use the

track ball/wheel to move to and highlight the Total All value and click on

it to display the totals of accounts in other currencies.

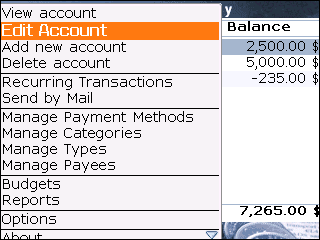

To

display the screen menu with the features available from the accounts screen

(Figure 4), click on the BlackBerry Key to the left of the track

ball/wheel.

Figure 4

View

Account (View Register) will display the transaction Register when your

expenditures and deposits are listed.

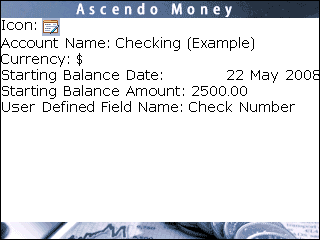

Edit

Account will allow you to change the account name, icon, initial balance

date, initial balance amount and user defined field label, see Figure 5.

Add

New Account will allow you to create a new account.

Delete

Account will delete the highlighted account. If you delete and account, all

of the transactions associated with the account will be deleted.

Figure 5

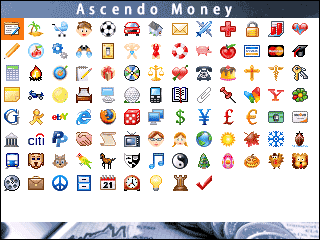

To select a new icon,

highlight the icon, click on the BlackBerry key and select Change Option. A

screen will appear with 100 icons, see Figure 6. Use the track ball to navigate

through the icons then click on the track ball to select an icon and return to

the account edit screen.

Figure 6

To

select a currency symbol, click on the “SYM” key on your BlackBerry.

When

you create an account, you may want to set the Starting Balance Date and

Starting Balance Amount using a bank statement. All transactions entered on

or after the Initial Balance Date will be reflected in the account balance.

If you fall behind on entering transactions, you may want to reset your

Starting Balance Date and Starting Balance amount to the most current bank

statement.

Each

account has a user defined field. You can set the field name to anything you

like and it will be displayed on the transaction form along with a value

field. In this example, the field name has been set to “Check Number” so

that when you enter you checking withdrawals, you can record the check

number.

Section 3.2 - Using Transaction Registers

The

Account Register is used to manage withdrawals and deposits to as well as

keep track of the account balance. To display the Account Register, go to

the accounts screen, roll the track ball/wheel to highlight an account, then

click on the track ball/wheel to display the account register.

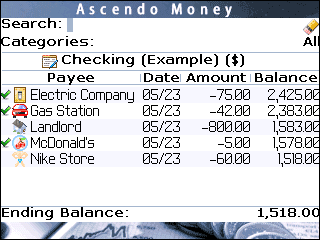

When

you use Ascendo Money for the first time, several sample transactions will

appear, see Figure 7. You can delete or edit these transactions.

Figure 7

The

transaction list displays several columns but there are more fields off the

right side of screen. In addition, there may be more transactions below the

screen depending on how many transactions you have entered. Ascendo Money

provides a Roll & Scroll TM feature that allows you to

navigate quickly and easily to the information you want. To use this

feature, use the track ball/wheel to highlight one of the transactions. Then

simply roll the track ball left or right to move horizontally across the

fields or roll the track ball up and down to move vertically through the

transactions.

Section 3.2.1 - Searching and Filtering Transactions

When

the register screen first appears, the cursor will be in the Search field.

If you start typing characters, Ascendo Money will reduce the list to only

those transactions for which Payee starts with the search string. For

example, if you start typing “m”, only the McDonald’s entry will appear in the

list. To clear the search field and display all transactions, click on the

BlackBerry escape key or the pencil button to the right of the Search field.

The

Categories field allows you to reduce the list to only transactions of a

particular category such as

Meals, Clothing, Entertainment. To select a category, roll the track ball to highlight

the Categories field value then click on the BlackBerry Key and select

change option. Alternatively, you can highlight the Categories field and

click on the space bar repeatedly to cycle through choices.

Section 3.2.2 - Adding, Editing and

Deleting Transactions

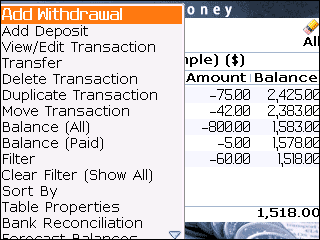

The transaction register screen menu provides several

options to manage transactions, see Figure 9. To display the screen menu,

click on the BlackBerry menu key.

Figure 9

From this menu you

can add a new transaction. Ascendo Money includes several features that

allow you to add transactions quickly. The transaction date will be set to

the current date and the cursor will be placed in the Payee field.

When you start

typing characters into the Payee field, Ascendo Money will automatically

suggest Payees. For example, if you start typing “E” then “Electric

Company” will be suggested. If this is not the payee you want then

continue typing. If it is the payee you want, then click on the return key

to automatically complete the entry and move to the amount field.

Payees are stored

in a separate database and have several default values associated with them

for Payment Method, Status, Category and Type. So if you select a payee

already in the databases, each of these fields will automatically be set to

the default values you have selected. For example, if you select Electric

Company, the Payment Method will automatically be set to ETF (Outgoing),

status will be set to “Unpaid”, Category will be set to “Utilities”

and Type will be set to “Personal Expenses”. You can override the

defaults by moving the these fields and selecting other choices.

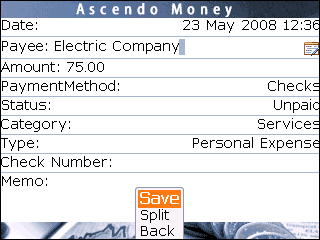

You can view or

edit a transaction by highlighting and click on it in the transaction list

or by choosing View/Edit from the screen menu. To save your modifications,

click on the BlackBerry key or track ball and select Save from the screen

menu, see figure 10.

Figure 10

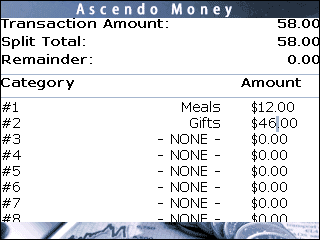

Section 3.2.3 - Splitting Transactions

Each transaction

amount can be split across several categories. For example, you might

purchase food and gifts in an airport store and classify the food as a

business expense and the gifts as a personal expense. To do this, select

Split

from the screen menu to display the transaction splitter screen, see figure

11.

Figure 11

In the list below the remainder field, select categories an type amounts to

allocate to each category. Ascendo Money will display the total of the

amounts you have allocated in the Split Total field.

The difference between the transaction amount and the total allocated

is displayed in the remainder field. When the remainder is 0, you have

allocated the entire transaction amount.

Section 3.2.4 -

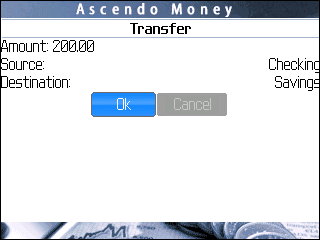

Transferring Money between Accounts

Transfers can be used to move money from one account to another. For

example, you may want to move money from your checking account to your

savings account. Instead of having to create two transactions manually,

Ascendo Money allows you to create a transfer in one step.

To display the

transfer screen in figure 12, select Transfer from the accounts screen menu.

Enter the amount you want to transfer and select the account from which you

would like to withdraw the money and the account into which you would like

to deposit the money. To select an account, use the track ball/wheel to

highlight the account selection value and click on the track ball/wheel to

display the choices. Highlight your choice and click on the track ball/wheel

to select the new value.

Ascendo Money

will create two transactions; a debit from the source account with Payee set

to "Transfer to Account Name", and a credit in the

destination account with the Payee set to "Transfer from Account

Name". Both transactions will be set to the amount you specified.

Figure 12

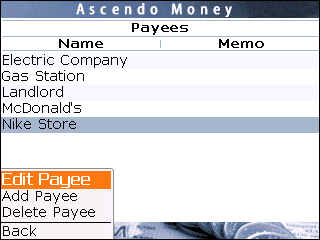

Section 3.3 - Managing Payees

Payees are people

or companies that receive payments from you, or that make payments to you. For

example, you may create a Payee named Vons Supermarket and record debit card

payments for groceries or a Payee with your employer’s company name to

record automatic salary deposits.

To manage Payees,

go to the Accounts Screen, click on the BlackBerry key and select “Manage

Payees” from the screen menu. The Payees will appear in a list displaying

the Payee name and Memo fields, see figure 13.

Figure 13

To

add or delete a Payee, roll the track ball/wheel to highlight a Payee, then

click the BlackBerry key to and select the desired action from the screen

menu. You can edit a Payee using the screen menu or by simply highlighting

and clicking on it with the track ball/wheel.

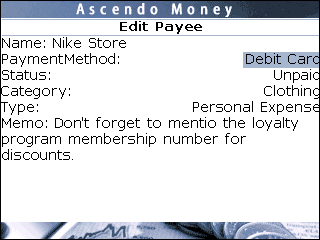

When

you shop at a store on a regular basis, you probably pay with the same

credit card want to categorize the purchase the same way. Ascendo Money

allows you to set up Payees with default values for Payment Method,

transaction Status, Category and Type, see figure 14.

When

you create a transaction and select a payee from the Payee database, these

fields will automatically be set to their default values. This speeds

transaction entry considerably however, you can override the defaults at any

time.

Figure 14

In

addition, each payee record includes a memo field to store information

specific to that Payee such as vendor contact information or purchasing

tips.

3.4 Payment

Methods, Status, Categories & Types

Each transaction

includes information on the payment method, transaction status, category and

type of the transaction. You can use this information to sort transactions

and display reports on your spending habits.

You can add, edit

and delete Payment Methods. The default Payment Types are listed in

the table below. Each payment

method must be declared as a withdrawal or a deposit to that Ascendo Money

knows whether to add or subtract the amount from the account balance.

For example, if you enter a

payment to your cable company and select EFT (Bill Pay), the amount will be

recorded as a withdrawal and subtracted from your balance. If you enter a

transaction for your salary and select EFT (Direct Deposit), the amount will

be recorded as a deposit to your account and added to the account balance.

|

Type

|

Withdrawal or Deposit

|

|

Withdrawal

|

Withdrawal

|

|

Deposit

|

Deposit

|

|

ATM

|

Withdrawal

|

|

Check

|

Withdrawal

|

|

Credit Card

|

Withdrawal

|

|

Debit Card

|

Withdrawal

|

|

EFT (Bill Pay)

|

Withdrawal

|

|

EFT (Direct Deposit)

|

Deposit

|

|

Paypal (To)

|

Withdrawal

|

|

Paypal (From)

|

Deposit

|

|

Wire Transfer (Outgoing)

|

Withdrawal

|

|

Wire Transfer (Incoming)

|

Deposit

|

A transaction's

Status

indicates whether it has has been processed by your bank. For

example, you may write a check for a purchase but the check may clear the

bank a week later. Tracking the status of transactions can be useful to

verify if your account is about to go negative in order to avoid bank fees

or interest payments.

You can add, edit

and delete transaction status types. The default status types are listed in

the table below.

|

Status

|

Paid

or Unpaid

|

|

UnCleared

|

Unpaid

|

|

Cleared

|

Paid

|

|

Unpaid

|

Unpaid

|

|

Paid

|

Paid

|

|

Unreconciled

|

Unpaid

|

|

Reconciled

|

Paid

|

|

Imported

|

Unpaid

|

|

Downloaded

|

Unpaid

|

|

Undetermined

|

Unpaid

|

|

Void

|

Unpaid

|

Categories and

Types allow you to classify transactions in order to better understand you

spending habits. For example, you might want to create a category for Meals

to track how much you spend each month.

Types

allow you to further classify transactions. For example, some of the

transactions in the Meals category could be personal

while others could be business related.

You can add, edit

and delete categories and types. When you start Ascendo Money for the first

time, there are several predefined categories such as Automotive, Clothing,

Entertainment, etc. and types such as Business Expense, Personal Expense,

etc.

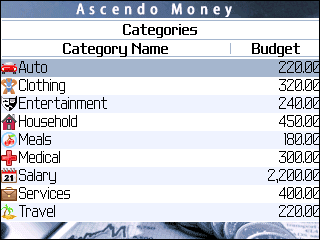

3.5 Managing

Budgets

Budgets allow you

to specify an amount that you would like to spend every month for

transactions of a certain category. For example, you may budget $250 per

month on clothing. If you buy a shirt and jeans for $125, you will have

spend 50% of your budget.

Budgets are set in the Category management screen. To set budgets, go to the

Accounts screen, click on the track ball/wheel to display the screen menu

and select Manage Categories, see figure 15.

Figure 15

To set a

budget, use the track ball/wheel to scroll down the list of categories and

click on the track ball/wheel to open the category edit screen. You can set

the Monthly Budget and choose if the category is an Expense or Income

Budget. Expense budgets are things you spend money on like meals or

utilities. An income budget could be used for revenues like salary or

consulting fees.

To

determine whether you are over or under budget for a category, go to the

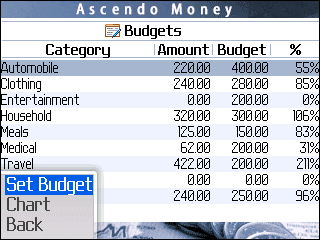

accounts screen and select Budgets from the screen menu, see figure 16.

Figure 16

The

category budget screen contains the Category Names in alphabetical order and

several other columns. The Amount column contains the sum of all

transactions of a category for the current month. The Budget column contains

the budget you choose for the category. The "%" column is the

percentage of budget that you have attained. A percentage under 100%

signifies that you have money left to spend on the category. A percentage

over 100% signifies that you have gone over budget.

You

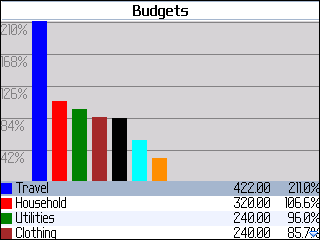

can set a budget and display a bar chart from the Budgets screen by clicking

on the track ball/wheel and select the option from the screen menu. Bar

charts display the categories in descending order of budget percentage

attained, see figure 17. You can use the track ball/wheel to move to

categories off the bottom of the screen.

Figure 17

3.6

Reports

Ascendo

Money provides numerous reports to help you analyze your financial

situation. To select a report, go to the accounts screen and select Reports

from the screen menu. A dialogue box with several report options will

appear, see Figure 18.

There

are several report types; Spending by Payee, Spending by Category,

Spending by Payment Method, Spending by Type and Deposits vs Withdrawals.

You can choose to display the data from one account or from all accounts.

The beginning and ending dates will determine the transactions that Ascendo Money

uses to create the

report. You can choose to view the report as a Pie Chart, Bar

Chart or in List View.

Figure

18

Figure 19

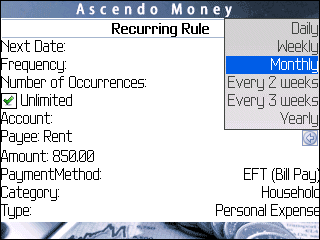

3.7

Scheduling Recurring Transactions

Some transactions occur repeatedly, such as

salary deposits or mortgage payments. To avoid entering the same transaction

over and over, Ascendo Money enables you to schedule recurring transactions for

a payee based on the frequency that you specified.

To

schedule a recurring transaction, go to the accounts screen and select

Schedule Transaction from the screen menu. A list of scheduled transactions

will be displayed. Now select Add Recurring Rule from the screen menu to

display the Recurring Rule screen, see Figure 20.

Figure 10

Scheduled

transactions will be created every time you start Ascendo Money based on the

date and the frequency you selected. For example, you could set up a

scheduled rent payment of $850.00 to occur every month. The Next Date is the

first date on which the transaction would occur. If you select next date to

be June 1st, then a Rent transaction would be created when you start Ascendo

Money on June 1st, July 1st, August 1st etc. You can specify a certain

number of occurrences or choose unlimited by checking the box.

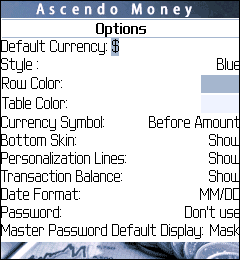

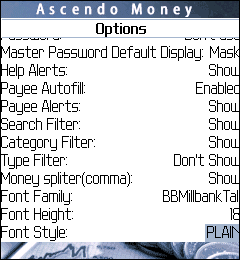

3.8

Customization

Options

Ascendo

Money for BlackBerry includes numerous user defined settings to to customize

fonts, colors, screen layouts and navigation. To

set these parameters, select Options from the Accounts screen menu, see

Figures 21 and 22.

Figure

21

Figure 22

3.9

Other Features

Ascendo Money for BlackBerry contains many of features to

help you achieve your financial goals.

3.9.1

Reconciling Accounts

Reconciling bank statements with transaction

registers can be useful to determine if there are fraudulent charges or

expenditures that you forgot to make note of. Ascendo Money provides an account

reconciliation feature for this purpose. To reconcile an account, select

Reconcile Account from the transaction register screen menu. Enter the beginning and

ending date of the period you want to reconcile. Ascendo Money calculates

beginning balance, ending balance, sum of reconciled transactions and the

difference, or un-reconciled amount.

3.9.2

Forecasting Account Balances

Ascendo Money allows you to forecast account balances at future dates. This can be helpful to adjust your spending

until the next payday. Ascendo Money will calculate your balance at any date

based on your current balance and scheduled transactions. To forecast a balance,

go to the transaction register screen and select Forecast from the screen

menu.

3.9.3

Purging

Transactions

Over

time, the number of transactions that you store in Ascendo Money may begin

to effect performance. You can purge transactions between a date range to

improve performance. Ascendo Money will remove these transactions and update

account balances. To purge transactions, go to the accounts screen and

select Purge from the screen menu.

|