User Guide - Ascendo Money - Personal Finance Manager for BlackBerry - Version 3

Chapter 4 - Using Ascendo Money Desktop

When you install software on a Windows PC, an application icon is placed on

the desktop, see Figure 23. Double-click on the icon to start Ascendo Money

Desktop. Alternatively, you can start Ascendo Money from the Widows start menu.

Click on the Start button, then click on All Programs. Scroll the list to find

the sub-menu for Ascendo Money, then open the submenu and click on Money.

Figure 23

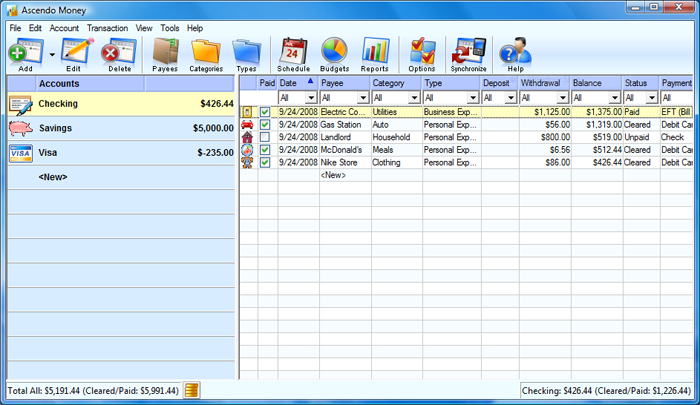

The

Ascendo Money main screen displays accounts in the left-hand panel and the

transaction register for the highlighted account in the right-hand panel,

see Figure 24. When you first start Ascendo Money, a few sample accounts and

transactions have been created but you can edit or delete them at any time.

Figure 24

The main text menu can be seen

along the top of the screen starting with the File menu. Click on the main

menu options to display submenus. A row of buttons is displayed underneath

the text menu to provide and quick and intuitive way to access regularly

used features.

You

can hide the account or transaction register panel by moving the divider to

the right or left. To show both panels again, move the divider closer to the

center of the screen.

Accounts and transactions can

be displayed in ascending or descending order by clicking on the column

headers.

Balances appear along the

bottom of the screen to indicated the sum of all transactions or the sum of

cleared or paid transactions.

Section 4.1 - Managing Accounts

Ascendo Money allows you to create an unlimited number of accounts

such as Checking, Savings, Debit Card, Credit Card, Retirement, Investments, etc.

Each account has a transaction register to manage deposits, withdrawals and

expenditures.

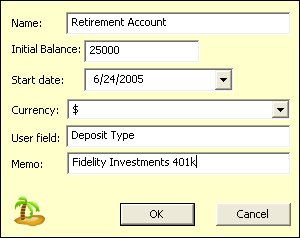

To add an account, click on

<New> at the bottom of the accounts list. Alternatively, you can click

on the arrow to the right of the Add button at the top of the Window and

select Add Account from the list. A form will appear containing several

fields, see Figure 25.

Figure 25

Enter an account name, initial balance,

balance start date and currency. Ascendo Money will calculate running,

ending and cleared balances by adding deposits and subtracting withdrawals

from the initial balance. Only transactions occurring on, or after the start

date with be used to determine balances. If your balances do not match with

your bank statement and you don't have the time to reconcile previous

transactions, you may want to move the initial balance and start date

forward to match your most recent bank statement.

The User field allows you to enter the field

label to be used for a field that you define in the transaction register.

For example, you could enter "Check Number" for checking accounts

to record the number of each check you write. In the example above (Figure

25), the user has set the User field label to "Deposit Type" and

could be used to record whether transactions in the account are deposits,

interest or dividends.

To edit an account, double

click on the account name in the account panel and the account form will

appear. To delete an account, highlight the account row and and click on the

Delete button. If you delete and account, all the transactions associated

with the account will be deleted as well.

At the bottom of the accounts

panel, two balances and and icon are displayed. The Total All field contains

the sum of all the accounts in the default currency. If all your accounts

are entered into Ascendo Money and they have been set to the same currency,

then the Total All is your net worth.

The Cleared/Paid column is the

sum of all transactions in the accounts that have a status set to cleared or

paid, meaning they have cleared your bank.

If you have accounts with

different currencies, Ascendo Money will display balances for accounts that

have been set to the default currency. You can change the currency used for

balances by clicking on the stack of coins icon to the right of the balances

and selecting another currency.

Section 4.2 - Using Transaction

Registers

Each account includes a transaction register to

track deposits, withdrawals and expenditures. For

example, you could create a personal checking account and record entries for

salary deposits, checks you write or debit card purchases. The

transaction register displays running and ending balances to help you avoid

overdrafts.

Section 4.2.1 - Filtering Transactions

You can filter transactions in the register

using the drop down fields below the column headers in Figure 24. For

example, if you click on the drop down arrow beneath the date column, you

can select a range of dates. Only the transactions between the dates you

selected will be displayed.

If you make selections from the drop down

lists, the balances at the bottom of the register will include "Filter

Set" before the balance amounts. To clear the filter, select

"All" in the drop down lists for each column.

Section 4.2.2 - Adding, Editing and

Deleting Transactions

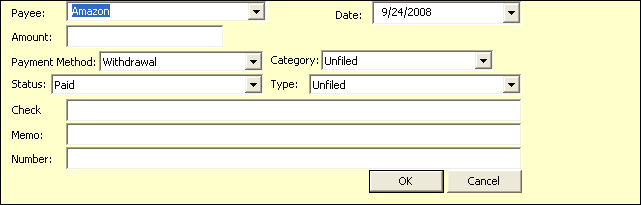

To add a transaction, click on <New>

in the last row of the register or click on the New button at the top of the

main window. A form will appear with several entry fields, see Figure 26.

Figure 26

You can select a Payee from the drop-down

list or enter it manually. If you start typing and a similar entry exists in

the Payee database, Ascendo Money will automatically suggest Payees starting

with the same letters and automatically complete the field if you click on

the Enter key.

Payees in the database may have default

values set up for Category, Type, Payment Method and Status. When you finish

selecting a Payee, these fields will be automatically filled with the

default values to help speed data entry.

To edit an transaction, double click on the

row in the transaction register or highlight a row and click on the Edit

button at the top of the main menu. To delete a transaction, highlight a row

in the transaction register and click on the Edit button at the top of the

main menu.

Section 4.2.3 - Splitting Transactions

Each transaction

amount can be split across several categories. For example, you might

purchase food and a present for a customer in an airport store and split the

transaction across the Meals and Gifts categories. To split a

transaction, select "SPLIT" from the categories drop down list. In

the transaction split form, select categories and amounts and

then click on the Add button. Continuing adding categories and amounts until

the sum is equal to the transaction amount.

Section 4.2.4 -

Transferring Money between Accounts

Transfers can be used to move money from one account to another. For

example, you may want to move money from your checking account to your

savings account. Instead of having to create two transactions manually,

Ascendo Money allows you to create a transfer in one step.

To make a

transfer using the Ascendo Money Desktop, highlight the account you wish to

transfer from. Then click on Account in the top row menu and select Transfer

from the submenu. Enter the amount and select the destination account from

the list.

Ascendo Money

will create two transactions; a debit from the source account with Payee set

to "Transfer to Account Name", and a credit in the

destination account with the Payee set to "Transfer from Account

Name". Both transactions will be set to the amount you specified.

Section 4.3 - Managing Payees

Payees are people

or companies that receive payments from you, or that make payments to you. For

example, you may create a Payee named Vons Supermarket and record debit card

payments for groceries or a Payee with your employer’s company name to

record automatic salary deposits.

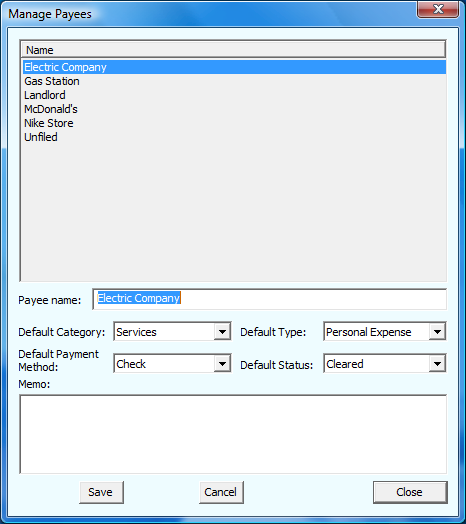

To manage payees,

click on the Payees button along the top of the main Window. A window will

appear containing a list of existing payees and a form to add or edit payees.

The first payee in the database will appear in the form with the fields

grayed out.

To add a payee,

click on the Add button at the bottom of the form, enter the fields and

click on the Save Button.

To delete a

payee, highlight a payee in the list and click on the Delete button at the

bottom of the window.

To edit a payee,

highlight it the list and click on the Edit button at the bottom of the

window. The

payee edit window, see Figure 27, contains several default fields and a memo

field. The values you select in the default field may be used to

auto-complete the transaction form when entering a new transaction.

.

Figure 27

4.4 Payment

Methods, Status, Categories & Types

Each transaction

includes information on the payment method, transaction status, category and

type of the transaction. You can use this information to sort transactions

and display reports on your spending habits.

You can add, edit

and delete Payment Methods. The default Payment Types are listed in

the table below. Each payment

method must be declared as a withdrawal or a deposit to that Ascendo Money

knows whether to add or subtract the amount from the account balance.

For example, if you enter a

payment to your cable company and select EFT (Bill Pay), the amount will be

recorded as a withdrawal and subtracted from your balance. If you enter a

transaction for your salary and select EFT (Direct Deposit), the amount will

be recorded as a deposit to your account and added to the account balance.

|

Type

|

Withdrawal or Deposit

|

|

Withdrawal

|

Withdrawal

|

|

Deposit

|

Deposit

|

|

ATM

|

Withdrawal

|

|

Check

|

Withdrawal

|

|

Credit Card

|

Withdrawal

|

|

Debit Card

|

Withdrawal

|

|

EFT (Bill Pay)

|

Withdrawal

|

|

EFT (Direct Deposit)

|

Deposit

|

|

Paypal (To)

|

Withdrawal

|

|

Paypal (From)

|

Deposit

|

|

Wire Transfer (Outgoing)

|

Withdrawal

|

|

Wire Transfer (Incoming)

|

Deposit

|

A transaction's

Status

indicates whether it has has been processed by your bank. For

example, you may write a check for a purchase but the check may clear the

bank a week later. Tracking the status of transactions can be useful to

verify if your account is about to go negative in order to avoid bank fees

or interest payments.

You can add, edit

and delete transaction status types. The default status types are listed in

the table below.

|

Status

|

Paid

or Unpaid

|

|

UnCleared

|

Unpaid

|

|

Cleared

|

Paid

|

|

Unpaid

|

Unpaid

|

|

Paid

|

Paid

|

|

Unreconciled

|

Unpaid

|

|

Reconciled

|

Paid

|

|

Imported

|

Unpaid

|

|

Downloaded

|

Unpaid

|

|

Undetermined

|

Unpaid

|

|

Void

|

Unpaid

|

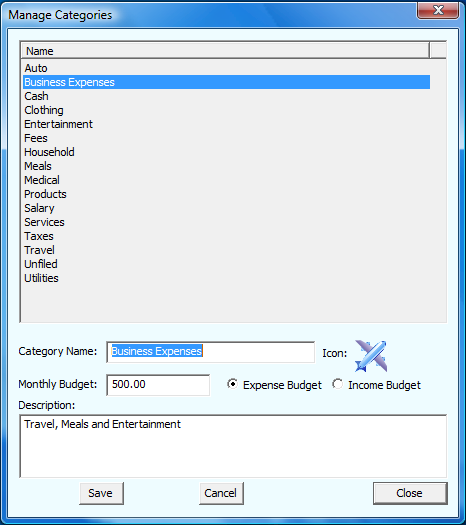

Categories allow you to classify transactions in order to better understand you

spending habits. For example, you might want to create a category for Meals

to track how much you spend each month. To display the category management

screen, see Figure 28, click on the Category button along the top of the

main application window.

Figure 28

Categories are

used to track budgets so you must specify a budget amount for each category

and whether it is an expense budget or an income budget.

Types allow you

to further classify transactions. For example, some of the

transactions in the Meals category could be personal

while others could be business related.

You can add, edit

and delete categories and types. When you start Ascendo Money for the first

time, there are several predefined categories such as Automotive, Clothing,

Entertainment, etc. and types such as Business Expense, Personal Expense,

etc.

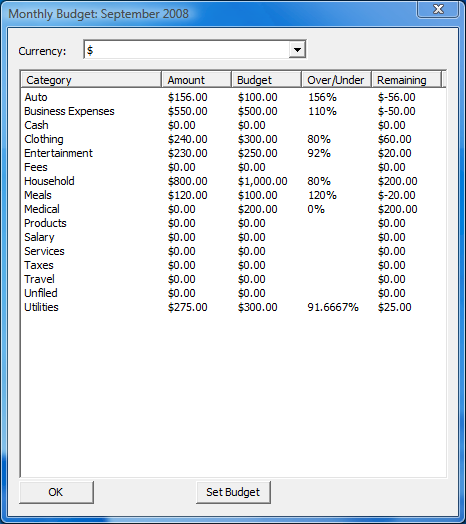

4.5 Managing

Budgets

Budgets allow you

to specify an amount that you would like to spend every month for transactions of a certain category. For example, you may budget $250 per

month on clothing. If you buy a shirt and jeans for $125, you will have

spend 50% of your budget.

To open the

Budget Management window, see Figure 29, click on the Budget button along

the top of the main application window. The Amount column displays the sum

of the transactions for a certain category for the current month. The

Percentage column indicates whether you are over or under budget. The

Remaining column tells you by how much.

Figure 29

To set a

budget, click on a category row and then click on the Set Budget button at

the bottom of the window.

4.6

Reports

Ascendo

Money provides numerous reports to help you analyze your finances. To select a report,

click on the Reports button along the top of the main application window. A

new window with several report options will

appear, see Figure 30.

Figure 30

There

are several report types; Spending by Payee, Spending by Category,

Spending by Payment Method, Spending by Type and Deposits vs Withdrawals.

You can choose to display the data from one account or from all accounts.

The beginning and ending dates will determine the transactions that Ascendo Money

uses to create the report. You can choose to view the report as a Pie Chart, Bar

Chart or in List View.

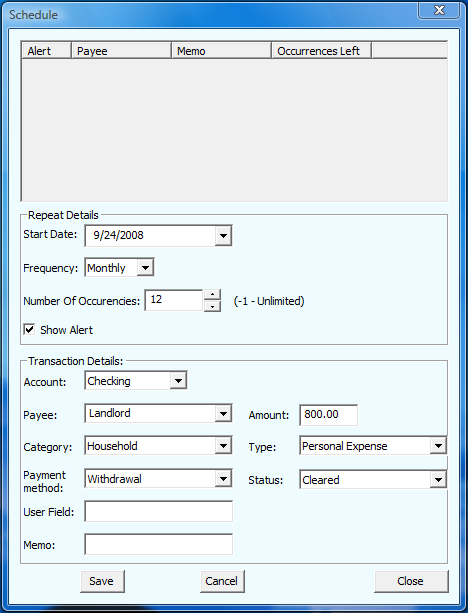

4.7

Scheduling Recurring Transactions

Some transactions occur repeatedly, such as

salary deposits or mortgage payments. To avoid entering the same transaction

over and over, Ascendo Money enables you to schedule recurring transactions for

a payee based on the frequency that you specified.

To

schedule a recurring transaction, go to the main window and click on the

Schedule button. A list of scheduled transactions

will be displayed. Now select Add Recurring Rule from the screen menu to

display the recurring rule edit form, see Figure 31.

Figure 31

Scheduled

transactions will be created every time you start Ascendo Money based on the

date and the frequency you selected. For example, you could set up a

scheduled rent payment of $850.00 to occur every month. The Next Date is the

first date on which the transaction would occur. If you select next date to

be June 1st, then a Rent transaction would be created when you start Ascendo

Money on June 1st, July 1st, August 1st etc. You can specify a certain

number of occurrences or choose unlimited by setting occurrences to -1.

4.8

Customization

Options

Ascendo

Money for BlackBerry includes numerous user defined settings to to customize

fonts, colors, screen layouts and navigation. To

set these parameters, click on the Options button along the top of the main

application window.

Conflict

Resolution tells Ascendo Money what to do if you synchronize Ascendo Money

for BlackBerry with Ascendo Money Desktop and the same information has been

changed on both sides. If you select Desktop Wins, Ascendo Money will

overwrite the same information on your BlackBerry or vice versa. If you

select Manual, you will be prompted each time Ascendo Money finds a conflict

and asked to specify which version of the information to keep.

Fonts

and colors used in the Ascendo Money Desktop main window can be changed from

the Tools text menu along the top of the main application window.

4.9

Other Features

Ascendo Money Desktop contains many other features..

4.9.1

Reconciling Accounts

Reconciling bank statements with transaction

registers can be useful to determine if there are fraudulent charges or

expenditures that you forgot to make note of. Ascendo Money provides an account

reconciliation feature for this purpose. To reconcile an account, select

Reconcile from the View menu. Enter the beginning and

ending date of the period you want to reconcile. Ascendo Money calculates

beginning balance, ending balance, sum of reconciled transactions and the

difference, or un-reconciled amount.

4.9.2

Forecasting Account Balances

Ascendo Money allows you to forecast account balances at future dates. This can be helpful to adjust your spending

until the next payday. Ascendo Money will calculate your balance at any date

based on your current balance and scheduled transactions. To forecast a balance,

go to the transaction register screen and select Forecast from the screen

menu.

4.9.3

Online

Bank Download

If

you have a bank account that allows online access from a web browser, you

can use Ascendo Money to download transactions. To use this feature, select

Download from Bank from the Accounts menu. Select a bank from the list and

enter the same username and password that you would use to access the

account from a desktop web browser, then click Ok.

4.9.4

Importing

and Exporting Data

Ascendo

Money desktop allows you to import information in several formats;

- Open

Financial Exchange (OFX) format is a secure protocol for transmitting

financial data supported by numerous banks and software vendors such as

Intuit and Microsoft.

- Quicken

Interchange Format (QIF) was developed by Intuit to exchange financial

information. Some version of Intuit products released in 2003, 2004 and

2008 support QIF.

- Comma

Separated Values (CSV) is an industry standard method for exchanging

structured information in text format.

Ascendo

Money supports exporting in QIF and CSV formats.

|